6 Budgeting Apps That Made Me Feel Less Anxious About Money

While financial stress isn't exactly a novel concept, our generation definitely feels the pinch more than ever: Research shows that one in three millennials experience anxiety about money. That's why this week, we're tackling financial wellness from every angle. Get expert advice on everything from the psychology of saving to investing when you have no clue where to begin. Financial empowerment is the ultimate goal—but you might just raise your bottom line, too.

I used to think that I'd finally feel like an adult when I hired someone to manage my budget. But recently, I've come to realize that taking ownership of my own financial strategy is even more empowering—and it's easier than ever, thanks to a whole marketplace of apps designed to help you make the most of your bank account.

The first step, of course, is assessing your own needs. Are you looking to invest some spare cash? Save for a down payment on a house? Get your budget in order? No matter the ask, financial freedom might just be a download away. Keep reading for our picks of the best budgeting apps to try this year.

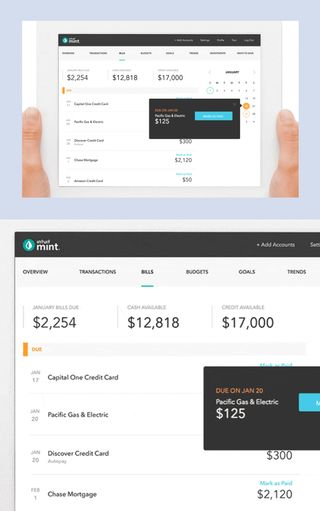

If you're looking to track your spending in real time: Mint

Mint is arguably the most popular personal finance app out there, and for good reason: Its interface syncs with all your different accounts (including investing, credit score, and bills) so that you have a single dashboard to manage all of your finances.

While I've tried many finance apps through the years, I've always come back to Mint because it's so user-friendly. The budgeting tool is especially useful, as it allows you to categorize every single purchase so that you can see exactly how you're spending your money and adjust accordingly.

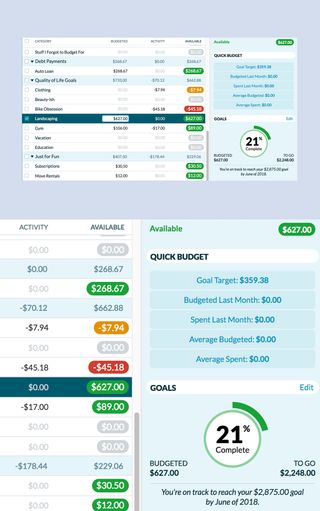

If you're ready to get aggressive about saving money: You Need a Budget

Whether you're looking to pad your savings in general or have a specific goal in mind, like a down payment or vacation, You Need a Budget (YNAB) is the ultimate tool. The platform's philosophy is that every dollar should have a job, whether it's covering necessary expenses or investing in your savings. By syncing with your bank accounts, you're able to see your spending habits on YNAB in real time—and you're expected to categorize every purchase so you know exactly what you're spending and why. This kind of scrutiny really helps you appreciate the value of every dollar you spend and make—an attitude that will only help bolster your goals.

At $84 a year, it's not the cheapest app of the lot (Mint, for example, is free). But if you're looking to get serious about saving, it might be well worth it.

If you want a financial planner without actually hiring a financial planner: Albert

A co-worker of mine says she's "obsessed" with this digital financial assistant, which assesses your income and spending patterns to suggest the ideal amount of savings to put aside each month. "It also has a 'smart-saving' feature, where you can set goals for what you want to have some money for, and it will assess your monthly spending and automatically allocate funds it knows you won't need to those mini savings accounts," she says.

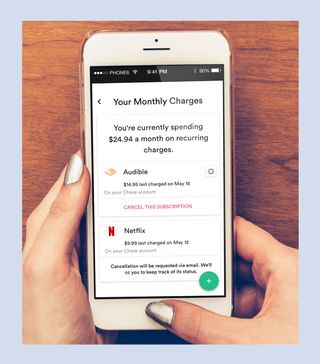

If you're tired of paying for subscriptions you no longer use: Trim

An abandoned dating app, a "trial" channel package on my cable bill, the web domain rights to my college blog… these are just a few of the subscriptions I unearthed from Trim, which automatically locates recurring purchases in your bank account. You'll probably want to keep some of them around, like Netflix, but chances are there's a small chunk of cash you've been throwing away each month for services you don't even use.

In addition to canceling your unwanted subscriptions, Trim will also try to negotiate your existing bills down on your behalf by locating different discounts and promotions for those services. It's a great way to locate some spare change each month, which ultimately adds up to a decent amount of savings.

If you want to start investing but don't know where to begin: Acorns

About a year ago, I knew I wasn't ready to start actively investing yet (beyond my 401(k), at least) but my stagnant savings account seemed like a missed opportunity. Enter: Acorns, which essentially puts your savings to work. The app invests your balance (no matter how small) in a portfolio tailored to your risk and goals. In addition to a monthly deposit from your bank account (I set mine for just $20), Acorns also rounds up your purchases and automatically invests the difference in your balance on the app—so you're contributing even more to your savings without even having to think about it.

Between these automatic roundups and dividends on my account, Acorns saved me an additional $600 last year. But cooler still is to see the app's projections of my savings decades from now, based on the market—and knowing that potential is a huge motivator.

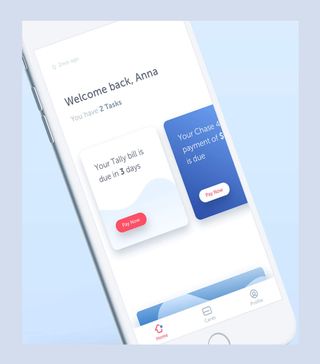

If you want to pay down your credit cards fast: Tally

Between the different interest rates, promo periods, and bill due dates, deciding how best to tackle credit card debt can be incredibly overwhelming. Tally aims to simplify it by consolidating your debt into one loan with a competitive interest rate. Instead of worrying about paying off each of your cards, Tally does it for you, so you never have to worry about late fees. Instead, you're just focused on paying down your Tally balance.

It's worth noting that Tally works best when you commit to stop using your credit cards altogether, as racking up even more debt kind of defeats the purpose. But for those who are hyper-focused on paying their cards down, this app is a smart way to go about it.

Next up: Here's how to deal with money-related anxiety.

Disclaimer

This article is provided for informational purposes only and is not intended to be used in the place of advice of your physician or other medical professionals. You should always consult with your doctor or healthcare provider first with any health-related questions.